To support the development of the university and the School of Mathematics, enhance students’ understanding of the financial industry, and cultivate talent interested in pursuing careers in finance, the alumni-run Merit Asset Management established the “Merit Future Finance Elite Program” Fund. Since 2024, the fund has organised summer internship programs in Hong Kong.

With the support of the “Merit Future Finance Elite Program” alumni fund, the School of Mathematical Sciences of Renmin University of China held its second summer internship program in Hong Kong from August 4 to 10, 2025. Compared with last year, the program added one additional spot. Following multiple rounds of selection, including preliminary material review and online interviews, three outstanding undergraduate students were chosen to participate: Xue Rui and Long Taozhi from the School of Mathematics, and Wang Chenxi from the School of Finance. During the program, the students visited several institutions and enterprises in Hong Kong, gaining close exposure to cutting-edge industry developments and broadening their international perspectives. Through a combination of theoretical learning and hands-on practice, they strengthened their understanding of financial knowledge, deepened professional insights and cross-cultural communication skills, and further enhanced their career competitiveness.

Setting Sail: The Immersive Internship Program Kicks Off

On August 4, the internship group arrived safely in Hong Kong and checked in at Merit Asset Management. Mr. Wang Haoyu, CEO of Merit Asset Management and distinguished alumnus, hosted a welcome meeting and presented an overview of the company’s strategic analysis. Afterwards, the team provided a detailed briefing on the internship program’s schedule and activities. Their thorough explanation sparked great anticipation among the students, marking the beginning of a meaningful and immersive experiential journey.

02

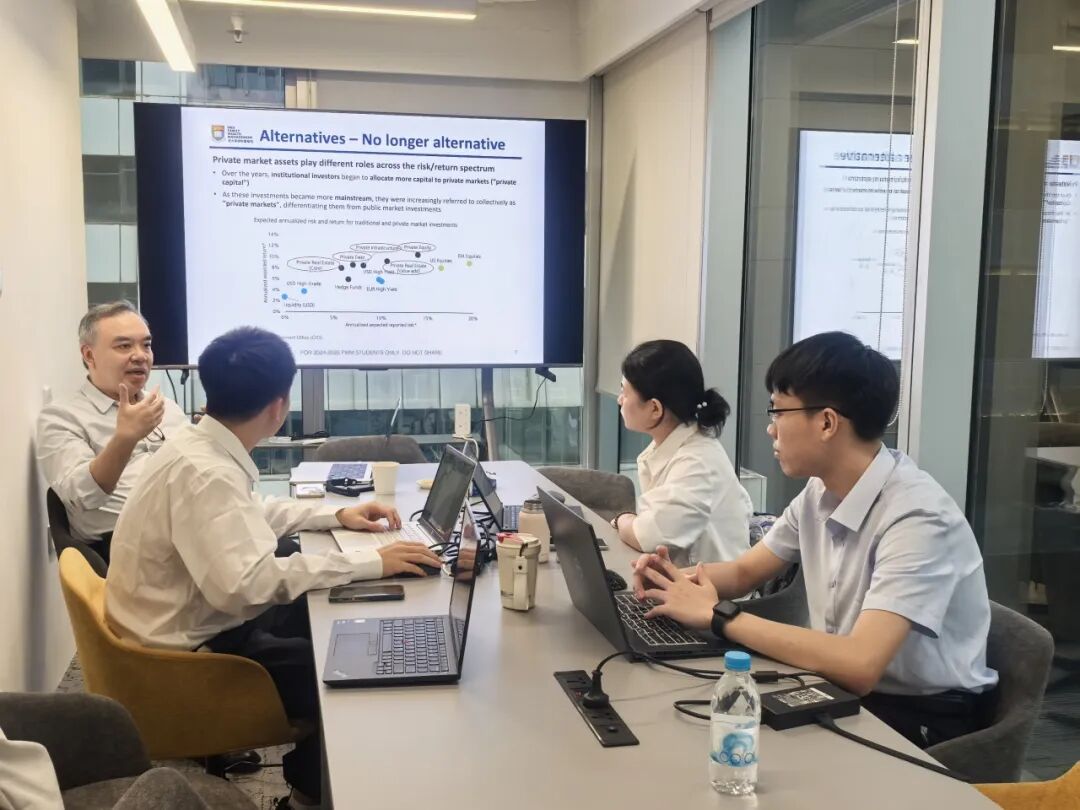

Thematic Seminar: Decoding the Core of Finance

On August 5, Hong Kong was hit by heavy “black rain,” and the internship team quickly shifted to an online format to continue their private equity-focused learning and project discussions. Alex, a senior private equity partner at Merit Asset Management, and Vivian from the company, guided the students through practical case studies, systematically explaining the full-cycle management logic and investment processes of private equity. From project screening and due diligence to post-investment management and exit strategies, they broke down the analytical framework for tackling complex problems. The students remained fully engaged throughout, deepening their understanding through real-time questions and group discussions, gradually mastering methods for risk assessment and value judgment.

On August 6, Vincent, a senior alternative assets partner at Merit Asset Management, focused on the private equity and private credit markets, further broadening the students’ understanding of alternative investments. That evening, Kevin from Merit Asset Management held a special session on structured products. From the logic of underlying assets to the mechanism of return distribution, he used vivid case studies to illustrate the innovative applications of financial instruments, enriching the students’ knowledge and providing fresh insights.

On August 7, the students actively participated in Merit Asset Management’s portfolio analysis and client post-investment meetings, and also attended a shareholders’ luncheon. Moving from “observers” to “participants,” they gained first-hand experience of the daily operations and decision-making processes of an asset management firm.

On August 8, Wendy, a partner at Merit Asset Management, drew on her own professional experience to provide the students with a deeper understanding of the firm’s overall business. She guided them through career paths in the asset management industry, role divisions, and the core competencies required, addressing their questions and concerns about career choices, and helping clarify directions for their professional planning.

03

On-Site Visits: Experiencing the Pulse of the Industry Up Close

The students visited four fund companies in person, learning about due diligence processes and engaging in activities related to real business negotiations. Before each visit, they reviewed background materials and prepared targeted questions for the on-site sessions. During the visits, from partners’ strategic sharing to fund managers’ operational reviews, and from investment-research system construction to the details of risk control, the students actively asked questions and participated in in-depth discussions. Through dialogues with top industry professionals, they not only clarified the operational workings of the asset management industry but also gained a tangible sense of the responsibility and commitment behind “professional rigour.”

On-Site Visits to Foreign Fund Management Companies:

Barings, Sectoral Asset Management

On-Site Visits to Domestic Fund Management Companies:

Tianyuan Capital, Taikang Asset Management

04

From “Learners” to “Practitioners”: Career Development and Personal Growth Go Hand in Hand

At the closing ceremony of the internship program, the three students presented their summaries and reports. They showcased the due diligence projects selected by their groups, detailing the logical frameworks, analysis processes, and research findings, demonstrating the significant growth achieved over the week. This was followed by individual reflections, where each student shared their key takeaways, personal growth experiences, and insights.

The internship program concluded successfully. This initiative not only exemplifies the School of Mathematics’s use of alumni resources to nurture talent but also provides a new model for university–enterprise collaborative education. Looking ahead, the School will continue to optimise internship programs, integrate high-quality alumni resources, offer richer practical opportunities, and build a “growth ladder” from campus to workplace, helping more students grow through hands-on experience and flourish through exploration.

Reflections from Participating Students

Xue Rui, Undergraduate, Class of 2027, School of Mathematics:

I would summarize this week’s internship in two words: challenge and reward. Every day I encountered a wealth of new knowledge, participated in various company due diligence and client meetings, and faced “crazy” tasks like preparing a 30-minute presentation on short notice… all of which required my full effort, less sleep, and more thinking.

With great challenges came equally great rewards. Previously, I mostly understood the financial industry from the perspective of a learner or outsider. This time, I truly experienced the inner workings of the private equity and private credit markets. I learned the logic behind decisions from the instructors, grasped the latest industry trends from company presentations, and gained substantial professional knowledge and analytical approaches from two exceptional senior students. Most importantly, this experience sparked my interest in the private equity market and asset allocation. As Vincent often says, one should find a career they truly love, as it will motivate them to strive for it throughout life. I believe this experience will greatly inform my future career choices and life planning.

Long Taozhi, Undergraduate, Class of 2026, School of Mathematics:

The Merit Asset Management summer internship provided me with invaluable opportunities to learn practical skills and gain hands-on experience, from which I benefited greatly.

During the sharing and teaching sessions, instructors drew on rich business experience to provide a comprehensive interpretation of professional content, helping me understand the full scope of the industry. In the due diligence sessions, I participated in investigations of multiple companies covering primary and secondary markets, as well as domestic and foreign backgrounds. Through discussions with instructors, I gained deeper insights into business models, development strategies, and product characteristics across different sectors, while also accumulating practical due diligence experience. Moreover, in-depth conversations with multiple senior professionals gave me a more comprehensive understanding of the financial industry. Their shared experiences and career advice inspired me and encouraged me to explore further opportunities in the future.

Wang Chenxi, Undergraduate, Class of 2026, School of Finance:

The Merit Asset Management summer internship marked a significant leap in my journey in finance. Guided by experienced mentors, I engaged deeply in project due diligence and discussions, allowing me, for the first time, to shift from a student mindset to an investor’s perspective, truly viewing market opportunities through an investor’s lens. Every in-depth dialogue with fund managers and asset managers, every rigorous due diligence meeting, gave me a profound understanding of the complex information systems behind financial markets and insights into the meticulous logic and comprehensive risk considerations behind investment decisions.

Interactions with the mentors at Merit Asset Management expanded my professional knowledge and offered valuable life wisdom. Their career insights and personal reflections helped guide my direction. I gradually learned how to anchor myself in the financial field, maintain focus and composure in the face of challenges, and, most importantly, dedicate sustained passion to work I truly love. These invaluable gains extend far beyond the brief internship period and will serve as a solid foundation for my future career and life journey. Additionally, interactions with my fellow interns allowed me to learn from their experiences and perspectives.

This invaluable experience has strengthened my passion for the financial industry. I have gained not only an understanding of the humanistic care and social responsibility embedded in financial operations but also a clearer vision of the broad space for my own development. The Merit Asset Management internship represents a new starting point in my financial journey. In the future, I will continue to deepen my expertise, enhance my professional and holistic skills, and look forward to contributing value on a broader financial stage and supporting the advancement of the industry.

Special Thanks

Merit Asset Management and Alumnus Wang Haoyu

Mr. Wang Haoyu, CEO of Merit Asset Management and an outstanding alumnus of the School, provided strong support for the successful implementation of this program with his extensive industry experience and management expertise. Alumnus Wang has nearly 20 years of experience in sovereign funds, public funds, and private equity investments. He has held positions including macroeconomist, senior asset allocation manager, and fund manager at the State Administration of Foreign Exchange (SAFE), directly managing assets worth hundreds of billions of dollars and carrying out asset allocation and direct investment work. He has also worked at several top global fund companies; served as fund manager and head of research at Rongtong Fund; and was Managing Director and Hong Kong CEO at Junshan Asset Management, responsible for capital markets and primary and secondary equity investments.